Daily Current Affairs for UPSC

Global Systemically Important Banks (GSIBs)

Syllabus- Economy [GS Paper-3]

Context- Along with UniCredit, Credit Suisse was removed from the list and the Bank of Communications of China was added for the first time, reducing the total number of banks from 30 to 29 in 2022.

What is Corporate Governance?

- GSIBs are financial institutions that are considered critical to the stability of the global financial system due to their size, interconnectedness, complexity and the potential impact of their failure on the economy as a whole.

- Methodology:

- G-SIBs were identified using the methodology developed by the Basel Committee on Banking Supervision (BCBS).

- The methodology uses indicators of bank size, global operations, substitutability, complexity and relationships when classifying the global systemic importance of banks.

- The number of G-SIBs is not fixed; it evolves over time, reflecting changes in the systemic importance of banks.

- Regulation:

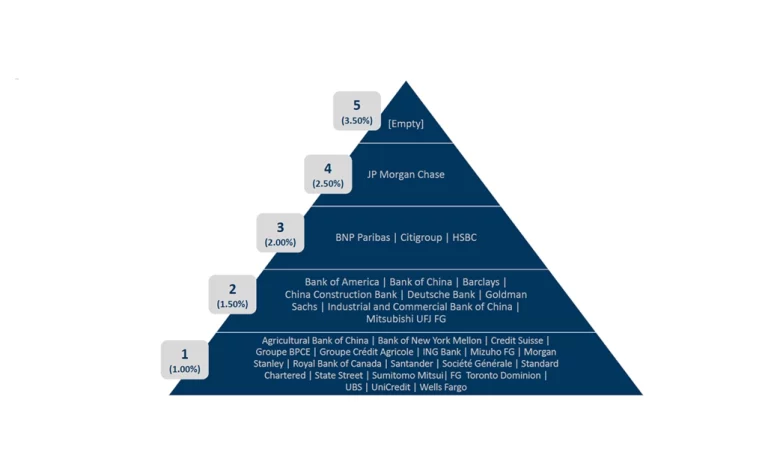

- Once designated as a GSIB, a bank will be subject to enhanced regulatory requirements aimed at reducing default risk and minimizing the impact of failure on the financial system.

- These requirements may include higher capital buffers, stricter risk management standards and the development of recovery and resolution plans.

- Need:

- The GSIB concept and related regulatory initiatives were developed in response to lessons learned from the global financial crisis in 2008.

- Financial Stability Board (FSB):

- This is an international body that monitors and makes recommendations on the financing of the financial sector, the global financial system, identifies and classifies GSIBs.

- It was established in 2009 as a successor to the Financial Stability Forum (FSF). The FSF was founded in 1999 by the finance ministers and central bank presidents of the G7 countries, following the recommendations of Hans Tietmeyer, president of the Deutsche Bundesbank.

Indian context

- The Reserve Bank of India (RBI) has designated State Bank of India, ICICI Bank and HDFC Bank as Domestic Systemically Important Banks (D-SIBs).

- The RBI published a framework for D-SIBs in 2014 and that framework requires the central bank to publish the names of banks designated as D-SIBs.

- Criteria: Criteria for a D-SIB designation include size, interconnectedness, non-substitutability and complexity.

- Regulation: Banks that meet specified criteria are classified as D-SIB and are subject to additional regulation and supervision to ensure the stability of the domestic financial system.

- Regulatory measures for D-SIBs may include higher capital requirements, increased risk management standards and other measures aimed at addressing the systemic importance of these banks.

- Usually, RBI reviews and updates the identifier of D-SIBs from time to time.

Source: The Hindu

.png)