Daily Current Affairs for UPSC

Disclosure Framework on Climate-related Financial Risks, 2024

Syllabus- Environment and Conservation [GS Paper-2]

Context

The Reserve Bank of India (RBI) has recently released a draft Disclosure Framework on Climate-related Financial Risks, 2024 for banks to follow.

About

- The regulated entities i.e., banks are meant to reveal statistics approximately their climate associated with economic risks and opportunities for the users of economic statements.

- It recognizes the importance of the environment and its long-term impact on businesses and the economic system as a whole.

What are Climate-associated Financial Risks?

- The RBI has defined climate-related economic dangers as the potential dangers that could rise up from weather change or from efforts to mitigate climate trade, their associated impacts and monetary and financial consequences.

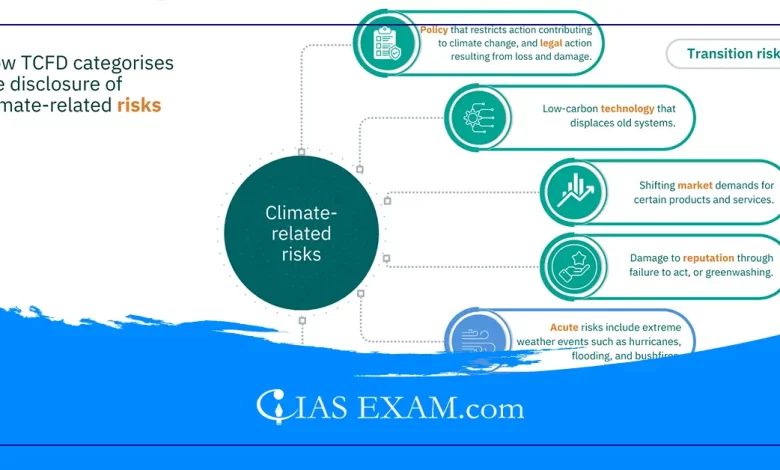

- It can affect the economic region through a huge channel i.e., physical risks and transition dangers.

- Physical Risks: It refers back to the financial costs and financial losses as a consequence of the increasing frequency and severity of intense climate exchange-related weather occasions.

- Impact on REs: Expected coins flowing to the REs from an exposure may be harassed at the incidence of a local / regional climate event.

- Chronic flooding or landslides can also pose a threat to the value of the collateral that REs have taken as security against loans.

- Severe climate events may damage a RE’s owned or leased physical assets and statistics centers, thereby, affecting its ability to offer monetary offerings to its customers.

- Transition Risks: It refers back to the dangers springing up from the system of adjustment towards a low-carbon economic system.

- A range of things affects this adjustment, which include modifications in climate-related policies and policies, the emergence of newer technology, shifting sentiments and behavior of customers.

- The process of transition i.e., lowering carbon emissions may additionally have a substantial effect on the economic system.

About the Framework

- All India economic establishments, and top and higher layer NBFCs will need to begin to provide statistics on governance, approach, and chance control approach from 2025-26 and begin disclosure metrics and goals from 2027-28.

- Banks might be mandated to reveal the ones weather-associated dangers which have a relation to their financial balance.

- The revelation will foster an early evaluation of climate-related monetary risks and opportunities and also facilitate market area.

Organisations under the Purview

- All scheduled commercial banks (excluding local area banks, payments banks and regional rural banks).

- All Tier -IV primary (urban) and cooperative banks (UCBs).

- All top and upper layer non-banking financial companies.

Disclosure by the REs

- Identified weather-associated risks and possibilities over short, medium and long time.

- The impact of weather-associated risks and possibilities on their corporations, strategy and financial planning.

- The resilience of the RE’s approach considering the one-of-a-kind weather eventualities.

Significance

- There is an urgent want for a better and steady disclosure framework for regulated entities, without which the economic risks can lead to mispricing of belongings and misallocation of capital.

- This basically led to a preferred disclosure framework on weather associated economic risks.

Source: The Hindu

UPSC Mains Practice Question

Q.Explain how Climate-associated Financial Risks affect India’s Economy? (200 words)

.png)