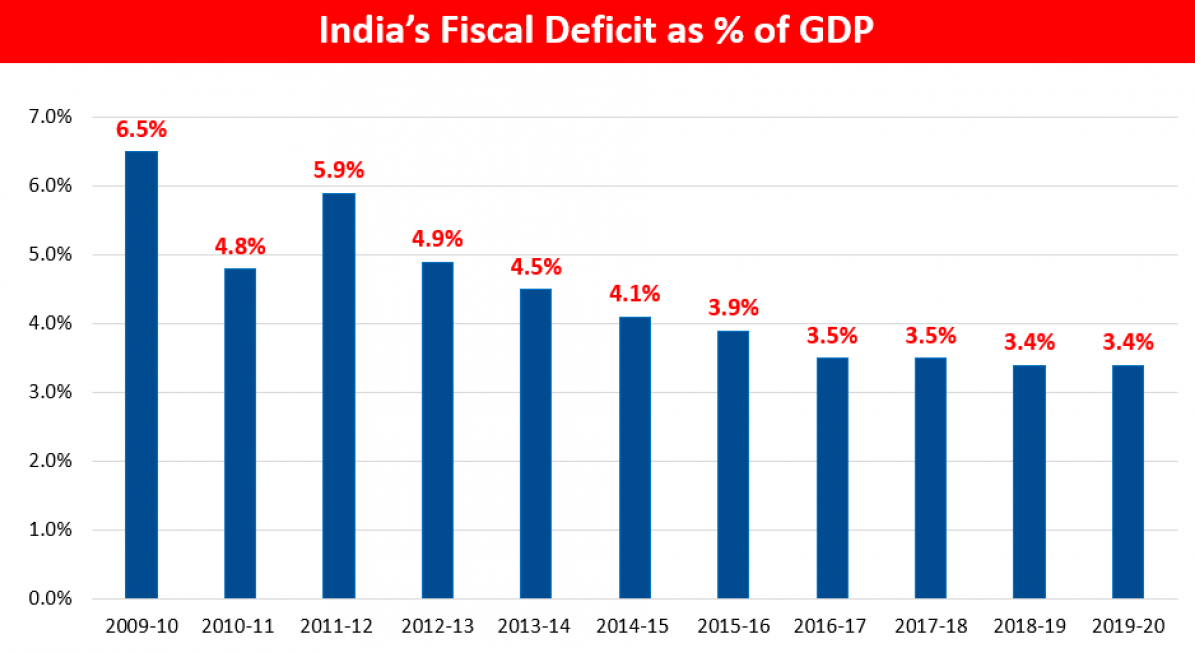

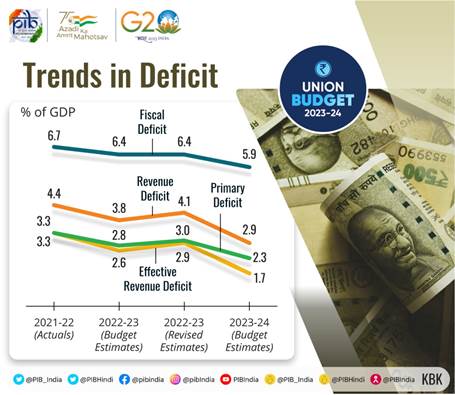

Context – In the Union Budget 2023-24, Finance Minister Nirmala Sitharaman chose the path of relative fiscal prudence and projected a decline in the fiscal deficit to 5.9% of the GDP in FY24 as compared to 6.4% in FY23.

She said that the Government plans to continue on the path of fiscal consolidation and reach a fiscal deficit well below 4.5% by 2025-26.

What is Fiscal Deficit?

- Fiscal Deficit is the difference between the total income of the Government (total taxes and non-debt capital receipts) and the total expenditure. A fiscal deficit situation occurs when the Government expenditure exceeds its income.

- In simpler words, it is the amount that the Government spends beyond its income and is measured as a percentage of the GDP.

- The Fiscal Responsibility and Budget Management (FRBM) Act was enacted in 2003, which sets a target for the Government to reduce fiscal deficits.

Current situation of Fiscal Deficit in India

- Reduced fiscal deficit target: In Union Budget 2023-24, the fiscal deficit to GDP is pegged at 5.9% in FY24. This ratio has declined from 6.4% in 2022-23 (revised estimate) and 6.7% in 2021-22 (actual).

- Reduced revenue deficit: In the revenue budget, the deficit was 4.1% of GDP in 2022-23 (revised estimate). In the Union Budget 2023-24, the revenue deficit is 2.9% of GDP. If interest payments are deducted from a fiscal deficit, which is referred to as the primary deficit, it stood at 3% of GDP in 2022-23 (RE).

- The primary deficit, which reflects the current fiscal stance devoid of past interest payment liabilities, is pegged at 2.3% of GDP in Union Budget 2023-24.

- India is ‘fairly’ confident to meet its target to cut its fiscal deficit by nearly 200 basis points to 4.5% of GDP in the next three years, assuming there is no major global economic shock.

- As economic growth continues and the government aims to cut spending on subsidies, the deficit should be able to fall to 4.5% of GDP by 2025/26.

What is Fiscal Consolidation?

- Fiscal consolidation refers to the ways and means of narrowing the fiscal deficit. A government typically borrows to bridge the deficit. It will then have to allocate a part of its earnings to service the debt.

- The interest burden will increase as the debt increases. In the Budget for FY22, of the total government expenditure of over ₹34.83 lakh crore, more than 8.09 lakh crore (around 20 percent) went towards interest payment.

- Debt is one liability that is difficult to defer and, at the end of the day, the government struggles to find more resources not just for capital expenditure but also for revenue expenditure. In the long run, the uncontrolled fiscal deficit will hurt economic growth.

Legal Mandate of Fiscal Consolidation in India

- The seeds for fiscal consolidation were sown in 1994 by the then Finance Minister Manmohan Singh. In his budget speech for FY95, he highlighted the need for fiscal discipline and pronounced a policy to end monetizing the deficit.

- As open market borrowings piled up to fund the deficit, Yashwant Sinha in his budget speech for FY01 called for a strong institutional framework to ensure fiscal responsibility. This resulted in the enactment of the ‘Fiscal Responsibility and Budget Management (FRBM) Act, 2003’, which mandated limiting the fiscal deficit to 3 percent of GDP.

Measures to be taken to achieve Fiscal Consolidation

- Fiscal policy needs to remain “accommodative” – with a focus on gross capital formation in the economy with enhanced capital spending, especially infrastructure investment.

- Enhanced capital spending – In Budget 23-24, capital spending is expected to rise to 3.3% of GDP. Ms. Sitharaman stressed that infrastructure investment has a larger multiplier effect on economic growth and employment. In this context, various schemes such as the National Monetization Pipeline, Gati Shakti Yojana, etc. have been launched.

- Helping states too – The interest-free loan of ₹1.3 lakh crore for 50 years provided to States should help them spend and boost growth.

- Increased revenue of the government – According to the CGA data for the first eight months of FY23, GoI’s gross tax revenues (GTR) has shown a growth of 15.5% which is just above the nominal GDP growth of 15.4% estimated for the full year of FY23. With this, the GoI’s GTR may be estimated at INR 31.3 lakh crore in FY23, exceeding the budgeted magnitude by about INR3.7 lakh crore.

- Reducing subsidies – Two favorable trends relate to the prospect of moderation of global crude prices accompanied by a fall in inflation. This may open up the possibility of reducing some of the relatively large petroleum price-linked subsidies. While the GoI has already committed to an expanded free food grain scheme under PM-GKAY, some of the fertilizer and petroleum subsidies may be reduced.

Associated Challenges

- Less consolidation by states – The states have less fiscal consolidation to do than the central government.

- Committing to High-quality spending – Both have a common challenge to commit to more capex, which is considered high-quality spending as it “crowds in” private investment if done responsibly. And we believe that investment is the only sustainable way to increase the capacity of the economy to grow and create jobs.

- Balancing the capex and fiscal consolidation – For the central government, the challenge is to hold on to its capex push at a time of fiscal consolidation. For the states, the challenge is to start doing more.

Way Forward

- Supporting growth in the short and medium term – Given the relatively lower revenue growth expected in FY24, it may be best to contain the growth of revenue expenditure and continue to emphasize capital expenditure growth as it is associated with higher multipliers.

- Infrastructure expansion should continue – to be the main priority for government expenditure while continuing to encourage Aatmanirbhar Bharat.

- Promote Employment Generation – The GoI may also need to signal its priority for employment creation. The sector that suffered the most during COVID-19 was trade, hotels, transport, storage etc. which is employment intensive. This sector would need to be supported through government programs that generate demand specific to these segments.

- Urban employment schemes – It would also be worthwhile considering whether the rural employment guarantee scheme should be extended to urban areas as has been done by some state governments.

- Raising the tax revenue through formalization – Continued formalization of the economy that raises tax revenues (though “organic” formalization will likely be more sustainable than “forced” formalization).

- Disinvestment of PSUs – A bigger push for disinvestment by selling stakes in public-owned companies, and further tax reforms (in terms of direct taxes and the GST).

Conclusion

Fiscal consolidation and capital expenditure should go hand in hand. More government spending means more infrastructure building and more chances of growth and employment. However, this spending should be done with a sound fiscal base. Thus, careful calibration would be required for limiting revenue expenditure growth in order to retain space for capital expenditure to grow adequately with a view to supporting growth.

.png)