Countering Chinese Monopoly over EV Market

[GS Paper 3 – Science & Technology and its Application in Everyday Life]

Context – The start of COP27 in Egypt has renewed the world’s focus on climate change. Electric vehicles (EVs) are key in the global quest to decarbonize. In India, which also faces serious air pollution issues, the transition to EVs is critical.

However, there is a China-size risk in the supply chain for electric vehicles. The recent saber-rattling across the Taiwan Straits ought to be a warning for the world. Given India’s troubled relationship with China, the risk may be even more acute.

About Electric Vehicles

- Electric vehicles (EV) are a part of the new normal as the global transportation sector undergoes a paradigm shift, with a clear preference towards cleaner and greener vehicles.

- The electric vehicle is a vehicle that runs on electricity alone. Such a vehicle does not contain an internal combustion engine like the other conventional vehicles. Instead, it employs an electric motor to run the wheels.

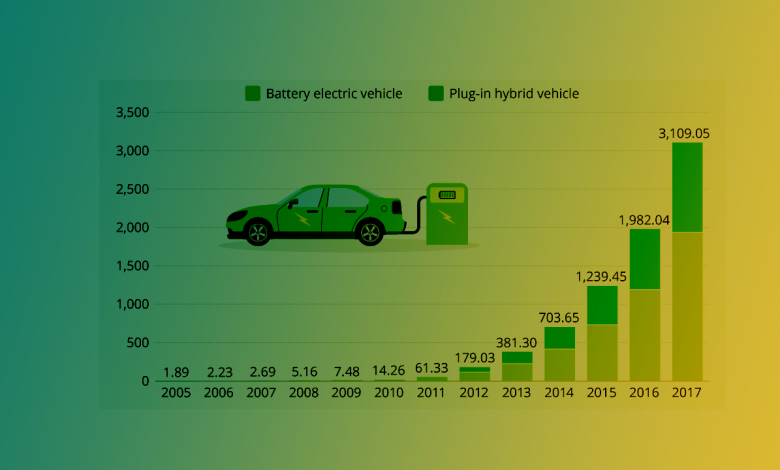

Global Status of EVs Production

- 50% of global EV’s production comes from China: EVs themselves, China has a share of around 50 per cent in global production.

- 25% from Europe: Europe is distant and stands at second position with 25 per cent.

- 10% from US: Surprisingly, the US is a small player in the EV supply chain, producing only 10 percent of vehicles and containing just 7 percent of battery production capacity.

- India’s position is still not noteworthy: India does not feature as a player of note.

- Every part of EV concentrated in China: According to a recent report by the International Energy Association, every part of the EV supply chain is highly concentrated, mostly in China.

- High global mining output of Key minerals, specifically graphite: The first stage of the supply chain is the key minerals required for batteries, namely lithium, nickel, cobalt and graphite. In graphite, China has an 80 per cent share of global mining output.

- Chinese control over Politically unstable DRC’ Mines of cobalt: In Cobalt, the politically highly unstable Democratic Republic of Congo mines two-thirds of the global supply and Chinese companies control a big share of that country’s mining.

- China dominates the processing of ore/minerals: Globally, over 60 per cent of lithium processing, over 70 per cent of cobalt processing, 80 percent of graphite processing and about 40 percent of nickel processing takes place in China.

- China’s heavy production of cell components: Other than Japan and South Korea, China produces two-thirds of global anodes and three-fourths of cathodes.

- Same case with the battery cells: China has a 70 per cent share in the production of battery cells.

What Strategy India can follow?

- Accelerating the mechanism of acquiring overseas mines of critical minerals: A recently formed government venture, KABIL, which is a JV between three minerals and metals PSUs, is tasked with the job of identifying and acquiring overseas mines.

- Liberalizing the domestic exploration policies: An alternate option is to liberalize exploration policies domestically, benchmark them with global best practices and invite global investors to find and mine in India.

- Stitching up the supply alliances: It is important to stitch up supply alliances with countries ex-China, as has been done with Australia. At higher ends of the value chain, from battery cells onwards, there is a need to invest much more in R&D.

- Making a vibrant startup ecosystem and public private partnership: A public-private partnership is vital. The vibrant startup ecosystem must be leveraged because it is more likely to be innovative than legacy firms.

Conclusion

The dragon has shown its evil side during the pandemic. China is weaponizing the trade to counter its adversaries. Excessive reliance on China for critical mineral resources is like falling into China’s trap. India and the world need to restrain China to have a monopoly over the Electric Vehicle market.

.png)